Get $17,000/year TAX FREE for Your Child's Education!

The Goal

To guarantee every child in California has equitable access to a high-quality education regardless of race, family income or zip code.

About The Initiative

The Children’s Educational Opportunity Act is a California statewide initiative set for the November 2026 ballot. It ensures that every TK to 12th grade student receives equal funding for all educational pathways, including public, charter, private, faith-based schools, and homeschooling. By addressing educational disparities, the act expands opportunities for all students, regardless of race, family income, or zip code.

Six Facts

1. Parents establish an Education Savings Account for their child

Parents can set up a state-controlled Education Savings Account (ESA) for their child from TK through 12th grade.

This ESA is funded annually using the student's portion of voter-approved Proposition 98 funds.

Initially set at $17,000, the amount adjusts yearly based on California's economic growth.

These funds do not increase taxes and are tax-exempt.

2. Parents choose the best education option for their child

Parents select an eligible school that suits their child best.

Options range from public and charter schools to private, faith-based institutions, and homeschooling.

The chosen school coordinates with the ESA Trust board to allocate funds for educational expenses.

Parents do not handle the money directly; transactions occur between the state-controlled ESA and the selected school.

3. Covered education expenses under the Education Savings Account

The ESA covers various educational expenses, including

• tuition,

• curriculum,

• books,

• online courses,

• religious and academic materials,

• school supplies and equipment, tutoring,

• testing fees,

• special needs services,

• transportation to and from school, and school-related activities.

4. Unused ESA funds roll over annually and accrue interest

Any unused funds within the student's ESA carry over each year, accruing interest to support future educational expenses throughout the student's life. This is not a voucher program where you lose the funding if you do not use it that year

5. ESA funds are usable throughout the student's lifetime

Beyond 12th grade, any remaining ESA funds can be applied to educational expenses for

• trade school,

• community college,

• university, and

• postgraduate studies.

This goes a long way to reduce or eliminate student loan debt.

6. ESA funds can be transferred to another ESA or donated to an eligible school

To ensure all ESA funds are utilized effectively, any unused portions can be transferred or gifted to another family member's ESA or donated to an eligible school.

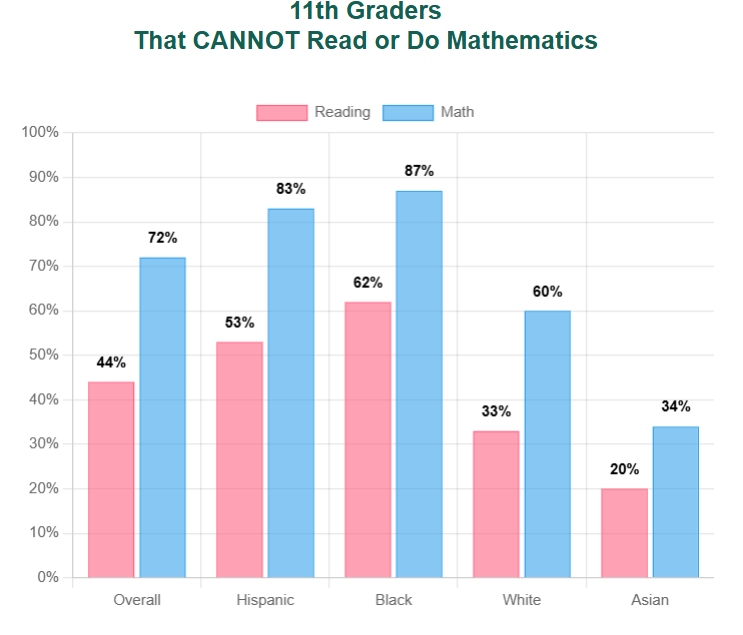

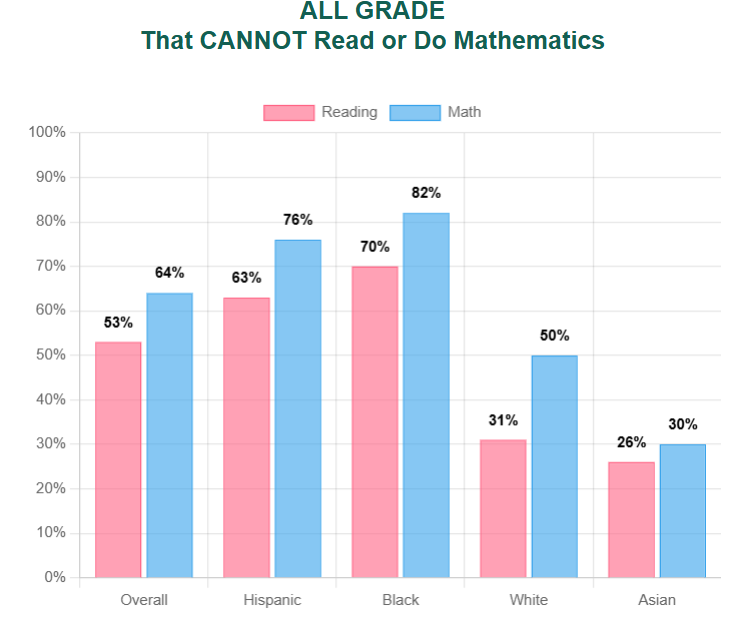

Research Studies Find That California Public Schools ...

Sources:

![]()

![]()

![]()

National School Choice Week is January 24-31, 2026!

Help us spread the word and gather signatures for the Children’s Educational Opportunity (CEO) Act, which would give every California family access to $17,000 per child, tax-free, to use toward the education option that works best for them.

Click the button below to find an event and spread the word about the CEO Act.